Plan For Higher Education

We know that you love your child a lot and you are little worried about his/her future but we also know that you’ll do your best to get the best child investment plans and give your kid a bright future. We want to assure you that we are there with you at this stage also; to plan and to provide best for your child.

As a parent you know that you’ll do whatever it takes to keep your little bundle of joy safe and happy.

This involves planning for their future, especially their education, which will determine the rest of their life.

Cost Rise Factor

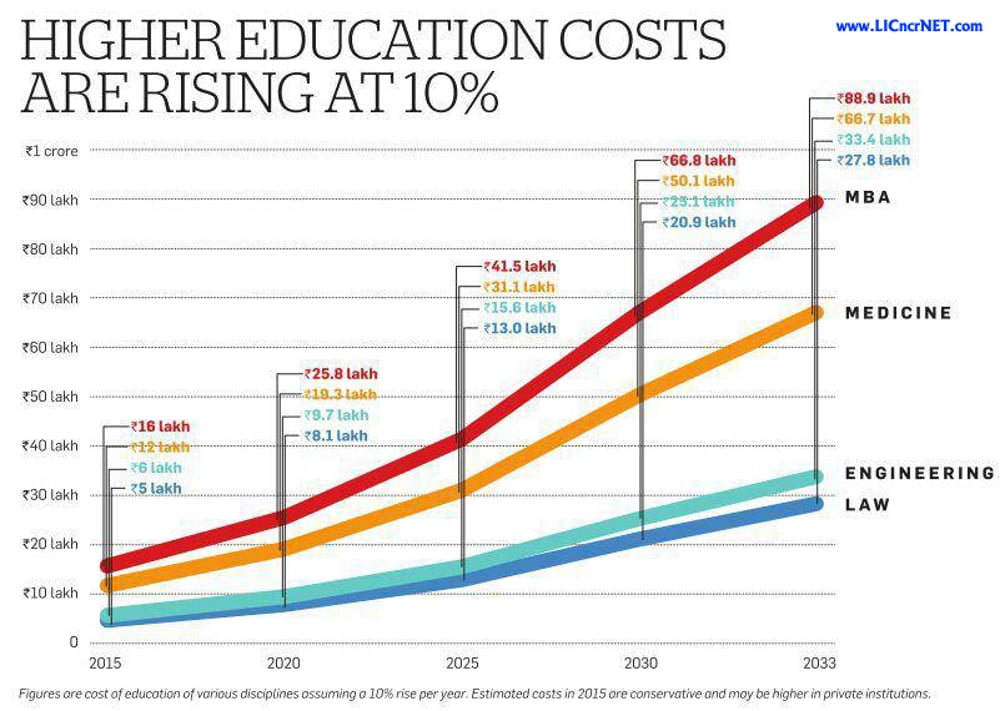

Sadly, education inflation is climbing at an alarming speed. In fact, the average rate of education inflation over the last 10 years is 7%. If we assume that this rate remains steady, the fees of specialized courses could double in the next 10 years!

1. Start by Understanding Your Child’s Goals

As your child starts to grow, you’ll be able to understand what they’re passionate about and what they may have an aptitude for.

By the time they reach the age of 10 or 12, you have to think about whether the kind of course they may have to do is available in India, or if specialized courses are available abroad.

Estimate what the cost of that course may be and how much time you have to save up.

2. Factor in Inflation

Since education inflation is increasing at a far higher rate than regular inflation, it’s imperative that you consider this while mapping out your financial plan for your child’s future. While the average rate of education inflation over the last 10 years is 7%.

Currently, a good business school has a fee structure of Rs. 25 lakhs. If we assume that your child will attend this business school in 15 years, and the rate of inflation is 8%, you’ll end up paying roughly Rs. 37 lakhs. However, if the rate of inflation goes up to 12%, you’ll have to pay Rs. 44 lakhs.

3. Choose Your Financial Tool

Now that you have a better understanding of the time frame you’re looking at and the kind of money you might require, it’s time to pick the financial tool that will help you meet your goal.

There are a number of investment avenues available to you, choose wisely.

why delaying will cost more?

there is no good time to start...

Now is the best time to start

As proud parents, you wish to do the best for your child and this includes providing everything that your child requires to grow further in life. The financial responsibilities that you have to handle for this are immense and you are willing to take all the decisions that will ensure a credible financial security for your child. One of the most important ways to ensure a safe future for your child where she/he can fulfill each dream is having a proper and comprehensive insurance plan in place for your child. These days there are many child-specific plans in place where you can choose to invest for a better financial future for your child. The options are diverse and therefore, you have to ensure that you take an informed decision, which can benefit your child in the long run.