Retirement Pension Plan

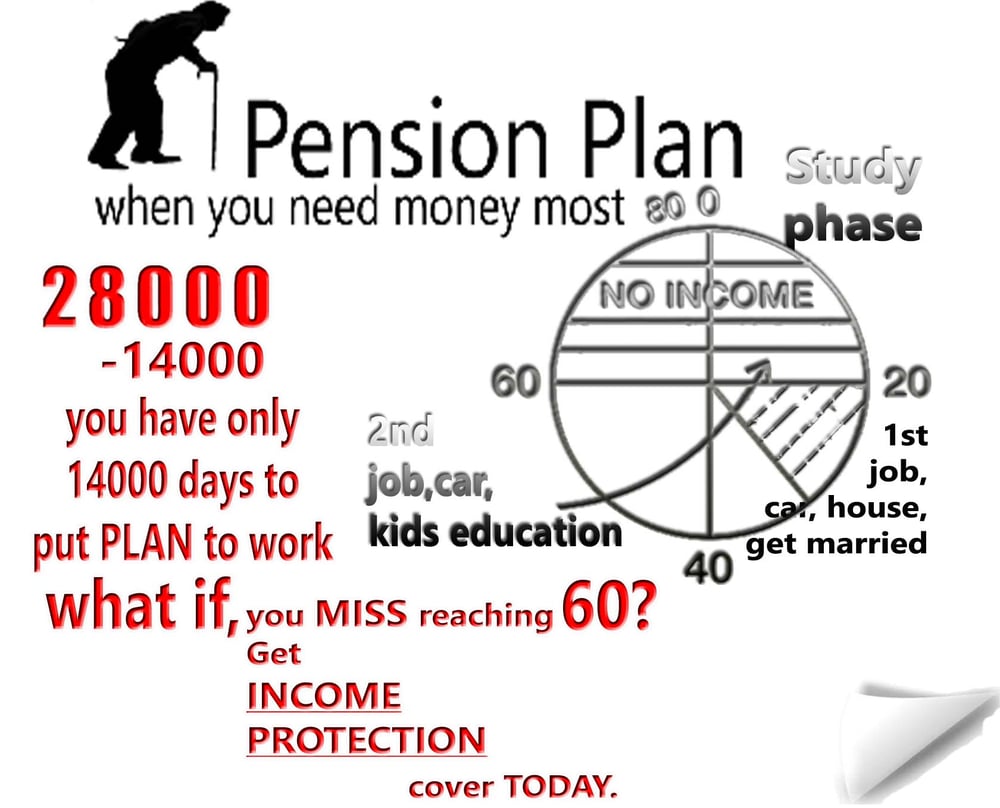

Retirement is a time when you can finally unwind and realize your long-held ambitions. However, if you are financially unprepared, it can be a difficult time.

As a result, it is in your best interest to consider a pension plan, also referred to as a retirement plans, and understand how important it is at a young age.

Why Do You Need Retirement and Pension Plans in 2021?

To enjoy a joyfull retirement life ahead, you should invest in retirement plans, which helps provide a guaranteed income after retirement to cater to your financial needs.

Not only this, Retirement Plans & Pension Plans also provide a death benefit which is payable on the death of the policyholder.

Pradhan Mantri Vaya Vandana Yojana

ONLY FOR SENIOR CITIZENS

For the welfare of senior citizens of our country

(The scheme is available up to 31st March 2023)

Get immediate pension annuity on single investments.

As per the terms and conditions under this plan, guaranteed rates of pension for policies sold during a year will be reviewed and decided at the beginning of each year by the Ministry of Finance, Government of India. For the first financial year i.e. upto 31st March 2021, the Scheme will provide an assured pension of 7.40% p.a. payable monthly.

Eligibility Conditions :

a) Minimum Entry Age : 60 years (completed)

b) Maximum Entry Age : No limit

c) Policy Term : 10 years

d) Minimum Pension :

Rs.1,000/- per month

Rs.3,000/- per quarter

Rs.6,000/-per half-year

Rs.12,000/- per year

e) Maximum Pension :

Rs. 9,250/-per month

Rs. 27,750/-per quarter

Rs. 55,500/-per half-year

Rs. 1,11,000/-per year

f) Minimum Investment : Rs.1,56,658/-

g) Maximum Investment : Rs.15,00,000/-

Total amount of purchase price under all the policies under this plan, and all the policies taken under Pradhan Mantri Vaya Vandana Yojana (with UIN 512G311V01 and UIN: 512G311V02) allowed to a senior citizen shall not exceed `15 lakh.

What is Retirement Planning?

The process of deciding your income goals for life post retirement, as well as the actions and decisions required to meet those goals, is known as retirement planning. Identifying sources of revenue, estimating costs, putting in place a savings plan, and controlling assets and risk are all part of retirement planning.

Your retirement plans can begin at any time, but it is most effective if you incorporate them into your financial planning at an earlier life stage. That is the most effective way to ensure a comfortable, stable, and enjoyable retirement.

Who Should Invest in Retirement & Pension Plans?

If you see financial security as a crucial part of your future, you should begin retirement planning and invest in a pension plan. However, anyone who meets the following points of reference should consider investing in the best pension schemes in India.

Learn more about

Learn more about what we do

Benefits of Pension Plans

1. Guaranteed Vesting Benefit

With retirement plans, you will get a fixed or guaranteed income to help you with your retirement planning. Not only this, but you might also get an option to provide the income to your spouse in case of your untimely death.

2. Death Benefit

Pension plans also provide a death benefit for the financial security of your family in your absence. The nominee will get the sum assured or death benefit in case of your untimely demise

3. Flexible Premium Payment Terms

With retirement and pension plans, you also get the flexibility to choose the premium payment term. You can select your premium payment term depending upon your financial goal.

4. Customize your Retirement Plan

With additional riders, you can customize your retirement plans to help you and your family avail additional protection.

5. Tax Benefits

Pension plans and retirement plans qualify for tax deduction under Section 80CCC of the Income Tax Act, 1961. You can avail tax deduction up to Rs.1.5 lakh for the purchase of a new policy or payments made towards renewal of an existing policy providing a pension or periodical annuity.

keep these critical features of pension plans in mind

Features of Pension Plans

1. Steady Flow of Income

Depending on how you invest in a pension plan, you will get a fixed and steady income after retirement (deferred plan) or directly after investing (immediate plan). This means that when you retire, you will be financially self-sufficient. You can use a retirement calculator to get a rough idea of how much money you will need when you retire and invest in the best pension plan in India.

2. Vesting Age

The age at which a pension plan's participant begins to receive a monthly pension is known as the vesting age. Most pension plans in India have a minimum vesting age of 40 to 50 years and a median vesting age of 70 years. You can choose any age between the minimum and maximum limit for when you want to start earning a monthly pension.

3. Surrender Value

It is recommended that you should not surrender a pension plan before the due date, or you will forfeit all benefits. You will still earn the surrender value of the plan if you still want to surrender it for whatever reason.

The surrender value is only granted after you have invested for the minimum amount of time in the plan. This benefit is typically only available with pension schemes in India that have a life insurance component.

4. Accumulation Period

An investor can pay the premium as a lump sum investment or in monthly instalments with retirement plans in India. Over time, the wealth would grow in tandem, resulting in a sizable sum. For example, if you begin investing at the age of 40 and continue until you reach the age of 60, you would have invested for 20 years. This corpus is where the majority of the pension payments will come from.

5. Payment Period

The payment period is when you start receiving your pension post-retirement. For instance, if a pension is received between the ages of 60 and 80, the payout period would be 20 years. When you look for the best pension plans in India, you will find that most plans have a distinct payment and accumulation period. However, some do allow partial or complete withdrawals during the accumulation period.

TRUST is the basic factor

Factors to Consider While Buying Pension Plans

1. Keep Your Budget in Mind

No one knows your expenses better than yourself—the monthly expenses as well as the upcoming significant expenditures in the future. And, with the increasing rate of inflation in India, you will likely need a larger income to survive when you retire than you do now.

Learning about your spending is a good place to start when it comes to retirement planning.

2. Plan Ahead of Retirement

The disparity between your working age and your expected retirement age determines how many years you must save for retirement. So, make sure you give yourself enough time to develop your money, regardless of where you invest.

3. Assess Your Risk Tolerance

Not only in retirement planning but in all types of investment planning, considering an individual's risk appetite is critical. So before investing your hard-earned money in the best retirement plans, make sure you understand your risk appetite.

4. Consider Income Sources

While your monthly paychecks will no longer be added to your account, you will be able to continue to earn money in other ways. You might, for example, earn a pension from your employer or own an extra home that you could rent out.

5. Consider Your Debts

Well, paying off debts may not be your priority in the present, you do not want to have outstanding debts later in life, especially when you are about to retire. When you get closer to retirement, it is best to pay off all your debts, to live a stress-free life with the support of the best retirement plans.

.

.

.